Aluminium prices in the UK continue to be a topic of interest for many businesses and consumers. Understanding these trends is crucial for making informed decisions and staying ahead of the market. In this comprehensive guide, we will consider the factors that influence aluminium prices in the UK, how to interpret price fluctuations, and strategies for navigating this ever-changing landscape.

Aluminium Price Trends in the UK

Aluminium is a versatile and widely used metal that has become an integral part of our daily lives. From construction materials to household items, aluminium can be found in almost every aspect of modern society. As such, understanding its price trends is crucial for various industries and consumers alike.

The UK is one of the major markets for aluminium, with a significant share in global consumption. Therefore, monitoring its price trends can provide valuable insights into the overall economic health and performance of the country.

Factors Affecting Aluminium Prices

Before delving into the current trends, it is essential to understand the factors that influence aluminium prices. The primary driver for aluminium prices is demand and supply dynamics. As with any commodity, when demand exceeds supply, prices tend to rise, and vice versa.

Other factors that impact aluminium prices include global economic conditions, political stability in major producing countries such as China and Russia, trade policies, currency fluctuations, technological advancements affecting production costs, and environmental regulations.

Current Trends in Aluminium Prices

Over the past decade or so, there has been a significant fluctuation in aluminium prices globally. In recent years (specifically from 2018-2020), there has been a notable decline in prices due to oversupply coupled with weakening demand caused by trade tensions between major economies.

However, since early 2021 onwards (after experiencing historic lows during 2020), aluminium prices have witnessed an uptrend due to several reasons. First and foremost being an increase in demand from key sectors such as automotive and construction as economies start recovering from the pandemic's effects.

Moreover, governments' focus on infrastructure development projects post-pandemic has also led to increased demand for aluminium products like aluminium sheets and aluminium angle. This trend is expected to continue over the coming years as governments worldwide aim at boosting their economies through infrastructure investments.

Additionally, there have been disruptions in alumina (a raw material used for producing aluminium) supply, leading to increased production costs. The increasing environmental regulations and the shift towards sustainable practices have also contributed to higher prices.

The aluminium price trends in the UK are closely tied with global dynamics, but they also reflect the domestic market conditions. While there have been significant fluctuations in recent years, the current trend suggests a steady increase in prices due to rising demand and production costs. As such, staying updated on these trends can help businesses make informed decisions and consumers plan their budgets accordingly.

What is the LME and Why is it Important?

LME, or the London Metal Exchange, is the world's premier market for industrial metals trading. It was founded in 1877 and has been a key player in setting global metal prices ever since. The exchange operates as an open outcry market, meaning that traders shout out bids and offers on the trading floor to buy and sell different metals, including aluminium.

The LME plays a vital role in setting aluminium prices in the UK and worldwide. This is because it acts as a benchmark for prices around the globe. Most physical trades of aluminium occur at or near LME official prices, making them widely recognised and accepted as accurate indicators of global supply and demand.

One of the major reasons why LME is important is due to its transparency. The exchange publishes real-time price information on all its traded commodities, including aluminium, providing market participants with valuable insights into price movements and trends. This transparency helps buyers and sellers make informed decisions based on actual market conditions rather than speculation or insider information.

Another crucial aspect of LME's importance lies in its ability to facilitate risk management. Companies involved in the production, consumption, or transportation of aluminium can use futures contracts traded on the LME to hedge against potential losses caused by adverse price movements. For example, if an aluminium producer expects prices to fall over time, they can enter a futures contract at a fixed price to ensure they will receive that amount when they sell their product at a later date.

Moreover, being listed on the LME gives greater credibility to aluminium suppliers and buyers alike. It provides assurance that transactions are conducted fairly within strict rules set by the exchange without any hidden agendas or manipulations.

The influence of LME extends beyond just pricing; it also impacts global trade flows. As one of the most liquid markets for industrial metals trading globally, fluctuations in prices set by LME affect investment decisions made by producers and consumers, ultimately shaping the supply and demand of aluminium in different regions.

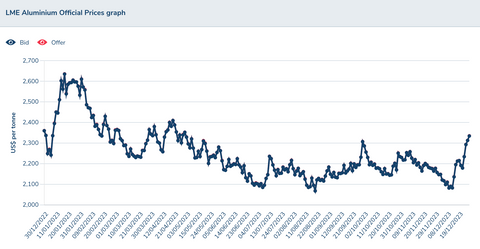

A Look at the Last 12 Months of Aluminium Price Fluctuations

Aluminium prices have been on a rollercoaster ride in the past year, with significant fluctuations that have left investors and industry experts alike scratching their heads.

The aluminium industry has always been subject to fluctuations in prices due to various factors such as supply and demand, global economic conditions, and production costs. As we move into 2024, it is important for businesses and individuals involved in the aluminium market to understand the potential future forecast and predictions for aluminium prices.

Experts predict that the aluminium market will continue to experience volatility in the coming years. However, there are certain trends that can help us make informed predictions about the future of aluminium prices in 2024.

One of the main factors that will impact aluminium prices is global economic growth. The International Monetary Fund (IMF) predicts a steady growth rate of around 3.6% for both advanced and emerging economies. This is expected to increase demand for products made with aluminium, leading to an increase in its price.

Furthermore, political changes and trade policies could also have a significant impact on aluminium prices. In addition, ongoing trade tensions between major economies such as China, Europe and the US may also lead to fluctuations in global commodity markets.

Another crucial factor that will affect aluminium prices is supply chain dynamics. Aluminium production requires bauxite ore which is mainly found in regions like Australia, Guinea, Brazil, Jamaica among others. Any disruptions or changes in mining activities or transportation routes from these countries can have a direct impact on the availability of raw materials which ultimately affects production costs.

Moreover, technological advancements are likely to play a major role in shaping future trends for aluminium prices. Innovations such as lightweight alloys made from recycled scrap metal are becoming increasingly popular due to their cost-effectiveness compared to traditional methods of producing primary aluminium from bauxite ore.

The Aluminium market is currently bullish with an upward trend; however, experts are suggesting this may slow down, but prices are not expected to fall in 2024. The overall outlook remains uncertain with market conditions being volatile and unpredictable.

A few tips for keeping your aluminium costs down

- Purchase bulk quantities: Buying in bulk can often lead to significant cost savings as suppliers may offer discounts for larger orders. This can be a smart strategy to adopt when aluminium prices are on the rise. At the Aluminium Warehouse we offer the best bulk discounts starting from just £150 (goods value). Our discounts range from 5% to 30% depending on total goods value being ordered.

- Shop around: Just like businesses, consumers can also benefit from diversifying their supplier base and shopping around for competitive pricing options. At the Aluminium Warehouse we constantly monitor pricing ensuring every order is very competitively priced.

- Consider recycling: As the demand for aluminium increases, so does its price. Recycling aluminium products not only helps reduce environmental impact but also decreases the demand for new production, potentially leading to lower prices. You may be surprised on how much you receive for recycling aluminium items – prices vary between £0.50 - £2.00 per kilo.

At the Aluminium Warehouse we keep extensive quantities of stock sourced in bulk from around the globe to protect our customers from price increases and fluctuations as much as possible.